Introduction

The global flexible packaging industry is experiencing significant growth, driven by key market trends in sustainability,e-commerce, and consumer convenience. Valued between approximately $258.7$ billion and $300.6$ billion in 2024, the market is robust and projected to grow at a Compound Annual Growth Rate (CAGR) of 5.2% to 6.0% through 2032 [1]. The Food & Beverage sector is the largest consumer, expected to account for up to 51% of the market [1], driven by the demand for packaged, convenient meals and extended shelf life.

The dominant material remains Plastic (primarily Polyethylene (PE) and Polypropylene (PP)) due to its low cost, durability, and excellent properties. Crucially, the demand for high-barrier films —which significantly restrict the transmission of Oxygen (OTR) and moisture (WVTR)—is strong, particularly in the food and pharmaceutical sectors where product integrity and shelf life are paramount [2]. Understanding these materials is the first step in strategic package design.

What are the most popular and essential material choices for flexible packaging?

The most essential material choices for flexible packaging are a family of polyolefins, which form the structural basis, complemented by specialized films that provide high-performance barriers.

1. Polyethylene (PE)

Polyethylene is the most widely used polymer in flexible packaging globally. PE (including variations like LDPE and LLDPE) is primarily used for the inner, contact layer of almost all flexible packaging (pouches and bags). It is the most cost-effective polymer, offering excellent heat-seal properties, which makes it the sealing layer in a laminate. Furthermore, PE provides a very good moisture barrier and is chemically inert, making it safe for direct food contact. Its high malleability and excellent tear and impact resistance ensure durability for heavy or stretched items.

2. Polypropylene (PP)

Polypropylene has a higher melting point than PE, making it ideal for packaging that is hot-filled, microwaved, or steam-sterilized. It offers a strong moisture barrier, making it excellent for keeping dry goods like snacks and cereals fresh and crisp. PP is often used in its Biaxially Oriented form (BOPP) to maximize its key properties: high transparency, stiffness, and gloss.

3. Polyethylene Terephthalate (PET)

PET is a high-performance polyester polymer renowned for its superior properties in laminated structures. It offers superior tensile strength and rigidity compared to PP and PE, making it the best choice for the outer layer of pouches. This strength provides structure, puncture resistance, and the ability to handle sharp or heavy contents. PET also provides an excellent inherent barrier against gases like oxygen and CO2, helping to extend the shelf life of perishable products.

4. Specialized and Complementary Materials

When selecting advanced flexible packaging, materials are often chosen specifically for their specialized barrier properties that go beyond standard polymers like PE and PP. These materials serve a primary purpose—either providing an ultimate barrier against external oxygen and moisture or boosting the mechanical strength of the package.

l Ultimate Barriers

Some materials are chosen when a product demands the absolute highest level of protection. Aluminum Foil is recognized as the ultimate barrier, aluminum foil provides a near-perfect block against moisture, oxygen, and light. This material is essential for products with extreme shelf-life requirements, such as sensitive pharmaceuticals, high-quality coffee, and retort (heat-sterilized) foods. Metallized Films offer a cost-effective barrier solution. They are created by depositing an extremely thin layer of aluminum vapor onto films like PET or BOPP.

l Specialized Polymer Barriers

Other specialized polymers are used to provide targeted barrier protection, often as a critical layer hidden within a multi-layer structure. EVOH (Ethylene Vinyl Alcohol) is utilized for its exceptional oxygen barrier performance, making it one of the most effective gas barriers available. While being a great gas barrier, its properties are highly sensitive to and compromised by moisture. PVDC (Polyvinylidene Chloride) is primarily used as a high-barrier coating applied to other base films. PVDC provides an excellent defense against both oxygen and moisture, making it a versatile choice for extending product freshness. Nylon’s (PA) primary purpose is providing puncture resistance and a good gas barrier. It is valued for its exceptional mechanical strength, which helps prevent product failure. For this reason, it is frequently used in vacuum packaging applications for items like meat and cheese, where integrity against sharp contents or rough handling is crucial.

How to Select the Right Flexible Packaging Materials for my products?

Selecting the right materials for your product packaging is a complex, strategic process that goes far beyond just appearance. It requires balancing four major categories of criteria: product protection, market appeal, cost/efficiency, and sustainability.A weak choice in any area can lead to product failure, regulatory fines, or consumer rejection, making this decision fundamental to your product's success.

Product Protection and Performance

The first and most critical area is product protection and performance. You must choose materials with the correct barrier properties to keep the product fresh and safe for its intended shelf life.

l Barrier Properties

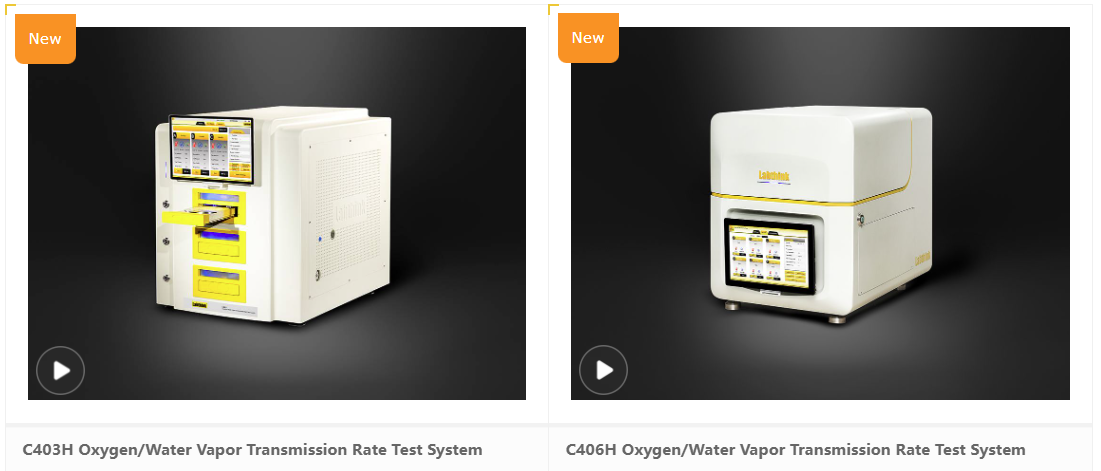

Products like coffee, dried food, and pharmaceuticals require excellent Oxygen Transmission Rate (OTR) and Water Vapor Transmission Rate (WVTR) barriers. It is important to prevent extends Shelf Life and maintains product quality, flavor, and texture. Poor barrier leads to spoilage and product recalls.

l Mechanical Strength,

The packaging's mechanical strength is equally important; it must be durable enough to survive dropping, stacking, and vibration throughout the entire distribution process without tearing or leaking. At the same time, it must offer consumer convenience. If the package is difficult to open—whether due to hard-to-tear notches or stuck bottle caps—it creates a frustrating user experience that can severely damage brand loyalty.

l chemical compatibility

This is especially important for food and medical packages. You must confirm chemical compatibility—the material must not react with the product (especially with acidic foods, oils, or cleaning agents) or leach harmful substances.

Beyondconsidering the packaging material's functionality, you must also ensure it aligns with your brand, target market, consumer experience, and key sustainability and compliance goals. The packaging is often the first and last point of contact. Does the material convey a premium feel or an eco-friendly image? Will the material allow for high-quality printing to create the necessary visual impact on the shelf? Does the material adhere to all regulatory standards, especially if they involve food contact? These are the questions that must be taken into consideration.

Selecting the right material for your product packaging is a critical, multi-faceted decision that impacts product safety, cost, marketing, and environmental footprint.

Conclusion

Selecting the right material for flexible packaging is a critical, multi-faceted decision that directly impacts product safety, cost, marketing effectiveness, and environmental footprint. By understanding the functional hierarchy of polymers like PE, PP, and PET, and strategically incorporating high-barrier specialists like Aluminum and EVOH, brands can achieve the required performance. This material strategy must then be rigorously validated through a comprehensive systematic testing plan. Ultimately, success in flexible packaging hinges on balancing material science with market strategy to create a safe, durable, and appealing product for the consumer.

References

[1] Fortune Business Insights. (2024). Flexible Packaging Market Size, Share & COVID-19 Impact Analysis, By Material(Plastics, Paper, Metal, and Others), By Type (Pouches, Films, Bags, and Others), By Application (Food & Beverages, Healthcare, Cosmetics & Toiletries, and Others), and Regional Forecast, 2024-2032. [2] Aris-Pack.(2025). Trends in Flexible Packaging Production in 2025.